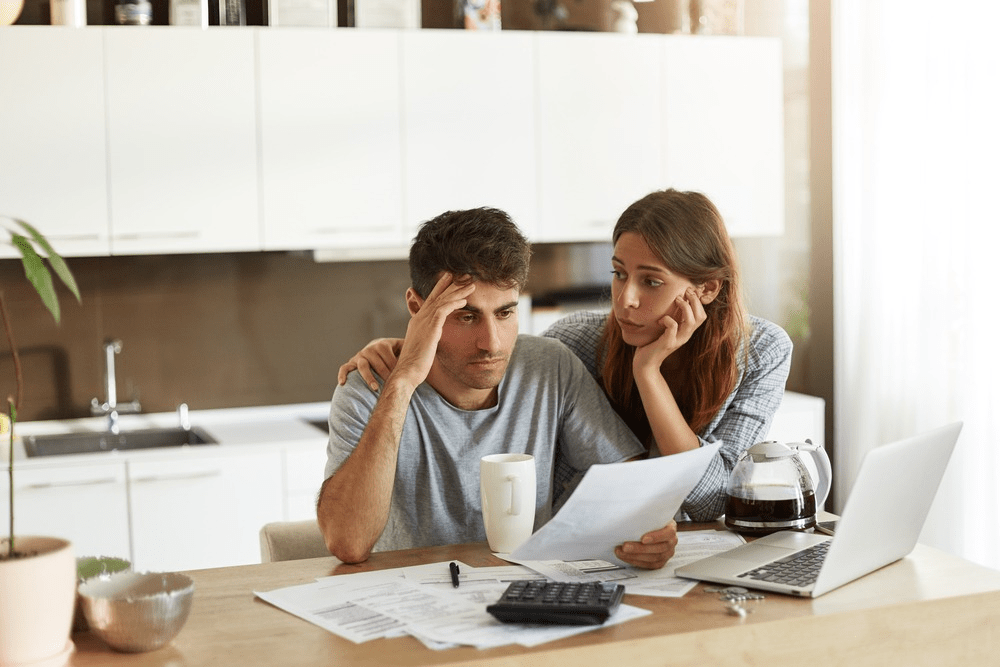

When you’re navigating the complexities of a lawsuit, the last thing you need is financial stress. Enter lawsuit loans, which can provide plaintiffs with a lifeline to cover daily expenses or legal costs while awaiting their settlement. However, finding the best lawsuit loan companies comes with its challenges. It’s essential to ensure they follow industry standards that prioritize fairness, transparency, and professionalism.

This article highlights the top five industry standards that every reputable lawsuit loan provider should follow to earn your trust and ensure a smooth borrowing experience.

1. Transparent and Upfront Fee Structures

One of the first hallmarks of a trustworthy lawsuit loan provider is full transparency regarding fees and interest rates. These companies should provide clear, upfront information about the costs associated with your loan, leaving no hidden charges to surprise you later.

Reputable providers also explain how interest will accrue and disclose their financial terms in simple, digestible language. Whether it involves a fixed interest rate or compounding interest, customers must understand these terms before signing any agreement.

Remember, a transparent fee structure allows you to compare options easily to find the best lawsuit loan that aligns with your financial situation.

2. No Credit or Employment Requirements

Unlike traditional loans, lawsuit loans should not depend on credit scores or employment histories. Lawsuit funding focuses on the merit of your case, not your financial standing.

A reputable lawsuit loan provider understands this principle, evaluating the strength and potential outcome of your case instead. If a provider insists on running a credit check that could affect your score or requests proof of steady employment, consider this a red flag.

The absence of such requirements ensures that this financial resource remains accessible to those who genuinely need it, regardless of their current circumstances.

3. Non-Recourse Funding

Industry leaders offering lawsuit loans follow a non-recourse funding model. This means that if you don’t win your case or fail to receive a settlement, you are not obliged to repay the loan.

This unique structure ensures plaintiffs don’t face additional financial burdens in the event of an unsuccessful case. To ensure peace of mind, always verify that your lawsuit loan provider adheres to this non-recourse funding principle.

Non-recourse funding not only protects your financial well-being but also demonstrates the provider’s confidence in the strength of your case.

4. Efficient and Straightforward Application Processes

Another important standard in the lawsuit loan industry is a streamlined application process. Providers that have earned a reputable standing offer simplified yet effective procedures to ensure plaintiffs can access the funds they need without unnecessary delays.

The application process typically includes:

- Submitting basic documentation about your case.

- Allowing the provider to work directly with your attorney for details.

- Receiving a quick decision, often within 24–48 hours.

By prioritizing efficiency, these providers help plaintiffs move forward without undue hassle, enabling them to focus on their legal battles instead of financial worries.

5. Ethical Business Practices

Ultimately, the best lawsuit loan companies uphold ethical business practices that are client-centered and maintain the integrity of the industry.

Key ethical practices include:

- Ensuring clear communication between all parties involved, including attorneys.

- Never pressuring plaintiffs into accepting terms.

- Following guidelines and industry regulations to protect consumer rights.

- Offering fair and competitive terms that align with the plaintiff’s best interests.

Providers that value ethics and professionalism prioritize long-term relationships and client satisfaction over quick profits. If they’re hesitant to answer your questions or provide vague information, it’s best to look elsewhere.

Why These Standards Matter

Choosing a lawsuit loan provider that abides by these industry standards gives you peace of mind and equips you with the financial support needed during uncertain times. Trustworthy providers ensure a transparent, ethical, and user-focused experience from start to finish, so plaintiffs can concentrate on what truly matters—their case.

When researching your options, review the terms, ask questions, and consult with your attorney. By aligning with a company that meets these expectations, you can confidently choose the best option for your needs.